Beyond the Savings Account: Why Investing is Your Irish Future (and How to Start Today)

- Kel Galavan

- Jul 27, 2025

- 17 min read

Ah, Ireland. The land of lush green fields, an educated and very capable population, and a surprisingly complicated relationship with money. Many of us grow up hearing that saving is the key to financial security, but what if I told you that just saving isn’t enough? That’s right - if you’re not investing, you might be missing out on something much bigger: your future wealth.

Why Investing is Your Irish Future

Let’s talk opportunity cost. Imagine you’re at a crossroads: one path leads to stuffing your savings into a high-interest account, and the other takes you into the thrilling (and sometimes a bit baffling) world of investing. Sounds simple enough, but here’s the kicker - by choosing the first, you’re actually handing over potential growth to inflation, taxes, and that nagging feeling that your money isn’t working hard enough for you.

The opportunity cost? All those years your money could have been compounding, quietly growing in the background while you focus on today’s worries.

Now, I know what you’re thinking - investing sounds complicated, risky even. And sure, there are no guarantees, but here’s the truth: long-term wealth building isn’t about chasing quick wins or risking it all on a punt. It’s about patience, consistency, and understanding that small steps now can lead to a sizeable pot down the line. Think of it as planting an oak tree - you don’t see the full height overnight, but with time, it grows mighty and strong.

Procrastination is Not an Investing Game Plan

Many Irish people procrastinate because they feel overwhelmed or think they need a fortune to start. But that couldn’t be further from the truth. The first step is often the simplest - becoming aware, setting clear goals, and taking manageable actions. Whether it’s regular contributions into a pension, investing in an ETF, or even a small lump sum into a diversified portfolio, these accessible steps are the foundation of future wealth.

And let’s not forget the big picture: long-term investing isn’t just about money - it’s about peace of mind, independence, and the freedom to enjoy life’s moments without financial stress. When we delay, we’re essentially telling ourselves, “I’ll do it someday,” but that someday might never come if we don’t start today.

So, to my fellow Irish friends, your future self is waiting - wealthier, calmer, more secure. The opportunity cost of not investing is not just missed euros; it’s missed dreams, opportunities, and the kind of financial freedom many of us only dream about. Don’t let procrastination steal that away. The time to plant your financial seeds is now - step by step, thing by thing - and watch as your future blossoms.

Understanding the Importance of Investing in Ireland

Investing in Ireland offers a unique opportunity to secure a calm confident future in one of Europe's most dynamic economies. With its strong tech sector, favourable business environment, and strategic location, Ireland has become a hub for innovation and growth. Understanding the importance of investing here can open doors to significant financial rewards and long-term stability, making it an essential consideration for anyone looking to build a solid financial foundation.

And we get to live here every day of the week!

The Benefits of Investing Today

Investing today is a powerful step towards securing your financial future and building wealth for the long term. By starting early, you can take advantage of compound interest, diversify your assets, and achieve your financial goals more effectively. Embracing investment strategies now can lead to a more stable and prosperous Irish future, providing peace of mind and financial independence.

Compounding Returns Over Time (The Magic of Money Making More Money!)

Investing offers the opportunity to build a secure financial future by leveraging the power of compounding returns over time. When you invest early, your money has more time to grow exponentially, allowing your investments to generate earnings that are reinvested to produce even greater gains. This cyclical growth can significantly increase your wealth, helping you achieve long-term financial goals such as homeownership, education, or retirement.

Compounding returns work best when investments are held over extended periods, enabling your initial capital and accumulated earnings to multiply steadily. The longer your money is invested, the more pronounced these effects become, making early and consistent investing a key strategy for maximising growth. By starting now, you benefit from the potential of market growth and interest accumulation, which can lead to a substantial financial advantage in the future.

Diversification of Income Sources (Don't Put All Your Eggs in One Basket!)

Investing today is a vital step toward securing your financial future, especially in Ireland where economic growth offers promising opportunities. By starting early, you can capitalise on compound interest and build wealth over time, ensuring stability and peace of mind for tomorrow.

One of the key benefits of investing now is diversification of income sources. Relying solely on traditional employment or a single income stream can be risky; investments such as stocks, bonds, real estate, or funds provide alternative avenues to generate income. This diversification helps mitigate risks, protect against economic fluctuations, and create multiple channels of cash flow, making your financial foundation more resilient.

Embracing diverse investments also allows you to adapt to changing market conditions and take advantage of various growth opportunities. As you build a broad portfolio, you're better positioned to weather downturns and maximise returns, ultimately helping you achieve financial independence and a brighter Irish future.

Achieving Financial Independence (Your Freedom Pass!)

Investing today offers a pathway to secure your financial future and achieve independence. By consistently putting money into investments, you can grow your wealth over time, benefiting from compound interest and market appreciation. This proactive approach helps you build a safety net for unforeseen expenses and future goals such as retirement, education, or starting a business.

Making smart investment choices early allows you to take advantage of time and market growth, ultimately reducing financial stress and increasing confidence in your financial stability. Achieving financial independence means having enough income from your investments to cover your lifestyle without relying on active work, providing greater freedom and peace of mind.

Moreover, investing today empowers you to participate in the economic development of Ireland and beyond, supporting local businesses and innovation. It encourages disciplined savings habits and financial literacy, essential tools for long-term success. Starting now ensures that you maximise opportunities, enjoy compounded returns, and create a legacy for future generations.

Popular Investment Options in Ireland

Investing in Ireland offers a diverse range of opportunities for both new and experienced investors. With a stable economy, favourable tax policies, and a growing financial sector, Ireland provides an attractive environment for various investment options. Understanding the popular investment choices available can help you make informed decisions to secure your financial future in Ireland.

Stock Market Investments (Become a Shareholder Hero!)

Investing in Ireland offers a variety of opportunities for individuals looking to grow their wealth and secure their financial future. The Irish stock market provides accessible options for both novice and experienced investors, with diverse sectors and investment instruments available.

Equity Shares: Investing in individual company shares traded on the Irish Stock Exchange can offer capital growth and dividends.

Mutual Funds: These pooled investment vehicles enable diversification across a wide range of stocks and bonds, managed by professional fund managers.

Exchange-Traded Funds (ETFs): ETFs provide a cost-effective way to invest in broad market indices or specific sectors within Ireland or internationally.

Government Bonds: Irish government-issued bonds are considered low-risk investments that generate steady income over time.

Corporate Bonds: Companies in Ireland issue bonds that can offer higher returns compared to government bonds, though with increased risk.

Quick Tips for Stock Market Investing in Ireland:

Stocks listed on the Irish Stock Exchange, including companies such as Ryanair, Bank of Ireland, and Kerry Group, offer investment opportunities aligned with Ireland's key industries. If you feel so inclined.

Participating in IPOs (Initial Public Offerings) of companies can also be a strategic move for early-stage investors.

Regularly reviewing market trends and economic indicators helps investors make informed decisions.

Seeking out the right advice that aligns with Irish regulations, tax and ensures you make the right investments for your investment strategy.

Property and Real Estate (More Than Just a Roof Over Your Head!)

Investing in Ireland offers a range of opportunities for building wealth and securing your financial future. Among the most popular options are property and real estate, which have long been considered reliable and lucrative sectors.

Irish property and real estate offer attractive investment prospects, thanks to the country's stable economy, growing population, and rising demand for housing. Investors can choose from residential properties, commercial spaces, or rental apartments, each offering potential for steady income and capital appreciation.

The Dublin property market is particularly notable for its high rental yields and strong appreciation rates, making it a favoured choice for both domestic and international investors. Additionally, regional cities like Cork, Galway, and Limerick are experiencing growth, presenting further opportunities for diversification.

Investing in Irish real estate also benefits from government incentives and favourable tax treatments for property investors. With proper research and strategic planning, property investment in Ireland can be a cornerstone of a robust financial future, especially when aligned with other diversified investment options.

Pensions and Retirement Funds (Your Future Self Will Thank You!)

Investing in Ireland offers a variety of options for securing your financial future, especially when it comes to pensions and retirement funds. These investment avenues are designed to help individuals build wealth over time while providing tax advantages and benefits tailored to Irish residents.

Popular investment options in Ireland include personal pension schemes, company pension plans, and self-directed retirement funds. Personal pensions allow individuals to contribute regularly, with the added benefit of government relief on contributions and tax-efficient growth. Company-sponsored pension schemes often include employer contributions and are a key component of employee benefits packages.

Retirement funds such as Approved Retirement Funds (ARFs) provide flexibility in managing your assets upon reaching retirement age, allowing you to withdraw income as needed while maintaining tax efficiency. Additionally, investment funds like unit trusts, Exchange-Traded Funds (ETFs), and mutual funds enable diversification across global markets, reducing risk and increasing potential returns.

Overall, these investment options are designed to support long-term financial stability, helping Irish residents prepare effectively for their retirement years and secure their future financially.

Government Bonds and Savings Schemes (The Steady Eddies of Investing)

Investing in Ireland offers a range of options to help secure your financial future. Among the most popular choices are government bonds and savings schemes, which provide safe and reliable ways to grow your wealth over time.

Government Bonds: These are bonds issued by the Irish government, offering fixed interest payments over a set period. They are considered low-risk investments and provide a steady return, making them suitable for conservative investors looking to preserve capital while earning income.

Savings Schemes: Ireland offers various savings products such as National Savings Certificates and Deposit Accounts. These schemes typically offer attractive interest rates, security of capital, and flexibility, encouraging individuals to save regularly for future needs like education, retirement, or emergencies.

Strategies for Successful Investing

Investing is a vital step toward securing a prosperous Irish future, providing opportunities to grow your wealth and achieve financial stability. Successful investing requires careful planning, understanding market trends, and adopting effective strategies to maximise returns. By exploring proven approaches and staying informed, investors can build a strong foundation for long-term success in Ireland's dynamic economy.

Setting Clear Financial Goals (Your Roadmap to Riches!)

Setting clear financial goals is a fundamental step towards successful investing and securing your financial future. By defining specific, measurable, achievable, relevant, and time-bound (SMART) objectives, you create a roadmap that guides your investment decisions and keeps you focused on your long-term aspirations. Whether saving for retirement, purchasing property, or funding education, having well-defined goals helps prioritise investments and manage risks effectively.

Developing a diversified investment strategy is essential to mitigate risks and maximise returns. This involves spreading investments across various asset classes like stocks, bonds, real estate, and alternative investments to reduce exposure to any single market's volatility. Regularly reviewing and adjusting your portfolio ensures alignment with evolving financial goals and market conditions.

Practising disciplined investing by maintaining consistency and avoiding emotional reactions to market fluctuations is vital. Adopting strategies such as dollar-cost averaging can help reduce the impact of market timing and build wealth steadily over time. Additionally, staying informed about market trends and economic indicators enables better decision-making and enhances your ability to adapt to changing circumstances.

Overall, setting clear financial goals, diversifying your investments, and practising disciplined habits are key strategies that will help you build a secure Irish future through successful investing. Staying committed to your plan and continuously educating yourself lays the foundation for achieving lasting financial stability and prosperity.

Understanding Risk Tolerance (How Much Sleep Will You Lose?)

Understanding your risk tolerance is crucial for successful investing and building a secure financial future in Ireland. It helps you determine how much market fluctuation you can comfortably endure without panicking or making impulsive decisions. By assessing your personal comfort level with risk, you can create an investment strategy that aligns with your financial goals and emotional capacity.

Strategies for successful investing include diversifying your portfolio across different asset classes to minimise potential losses, setting clear and realistic objectives, and maintaining a long-term perspective. Regularly reviewing and rebalancing your investments ensures they stay aligned with your evolving risk tolerance and financial aspirations.

Educating yourself about various investment options and staying informed about market trends can help you make confident decisions. Remember, patience and discipline are vital components of successful investing - staying the course even during market volatility will support your journey toward a prosperous Irish future.

Diversifying Your Portfolio (Don't Put All Your Eggs in One Basket!)

One of the key strategies for successful investing is diversifying your portfolio. This involves spreading your investments across various asset classes, such as stocks, bonds, real estate, and commodities, to minimise risk. By doing so, you reduce the impact of any single investment's poor performance on your overall portfolio. Diversification helps ensure that your investments are not overly reliant on one particular market or sector, providing stability and potential for consistent growth over time.

Regular Monitoring and Adjustments (Keeping Your Eye on the Ball)

Effective investment strategies are essential for securing a prosperous future in Ireland. Developing a diversified portfolio helps mitigate risks and maximises potential returns over time. Regular monitoring of your investments allows you to stay informed about market trends and the performance of your assets, enabling proactive decisions.

Adjusting your investment approach in response to changing economic conditions and personal financial goals is crucial. Rebalancing your portfolio periodically ensures that your asset allocation remains aligned with your risk tolerance and objectives. By maintaining discipline and staying informed, you can build a resilient investment plan that supports your Irish future.

Tax Benefits and Incentives in Ireland

Ireland offers a range of tax benefits and incentives designed to attract investors and foster economic growth. These programmes aim to create a favourable environment for both local and international businesses, making Ireland an appealing destination for investment. Understanding these incentives can help investors maximise their returns while contributing to the country's development.

Tax Relief on Pension Contributions (Your Pension Perks!)

Tax benefits and incentives in Ireland play a significant role in encouraging individuals to invest for their future. One of the key advantages is the tax relief on pension contributions, which allows contributors to claim tax relief at their marginal rate on their pension payments, effectively reducing their taxable income. This incentive not only helps individuals build their retirement savings more efficiently but also provides immediate tax savings, making pension schemes an attractive option for long-term financial planning. Additionally, Ireland offers various other tax incentives to promote investments, such as capital gains tax exemptions on certain assets and reliefs on specific investment types, all designed to support a sustainable and prosperous Irish future.

Investment Incentives for First-Time Buyers (Getting a Leg Up on the Property Ladder!)

Ireland offers a range of tax benefits and incentives designed to encourage investment and support new homebuyers. These include schemes such as the First-Time Buyer Relief, which reduces stamp duty costs for those purchasing their first property. Additionally, the Help to Buy scheme provides financial assistance to qualifying first-time buyers, making it easier to enter the property market. The country’s favourable corporation tax rate also attracts foreign investors and businesses, fostering economic growth. These incentives collectively create an advantageous environment for investors looking to secure their Irish future.

Tax-Efficient Saving Schemes (Making Your Savings Work Smarter!)

In Ireland, there are several tax benefits and incentives designed to encourage saving and investment, making it an attractive environment for investors. These schemes help individuals optimise their financial growth while minimising tax liabilities, supporting long-term financial planning.

Tax-efficient saving schemes such as Personal Retirement Savings Accounts (PRSAs), Approved Retirement Funds (ARFs), and Personal Equity Plans (PEPs) offer significant tax advantages. Contributions to these schemes often attract tax relief, and the investment growth within them is typically exempt from capital gains tax and income tax. Additionally, certain government initiatives like the Employment Investment Incentive Scheme (EIIS) provide tax reliefs to investors in qualifying small and medium-sized enterprises, promoting innovation and economic development in Ireland.

By leveraging these tax benefits and incentives, Irish investors can enhance their savings potential, secure a more prosperous future, and contribute to the country's economic growth - making investing a vital part of shaping your Irish future.

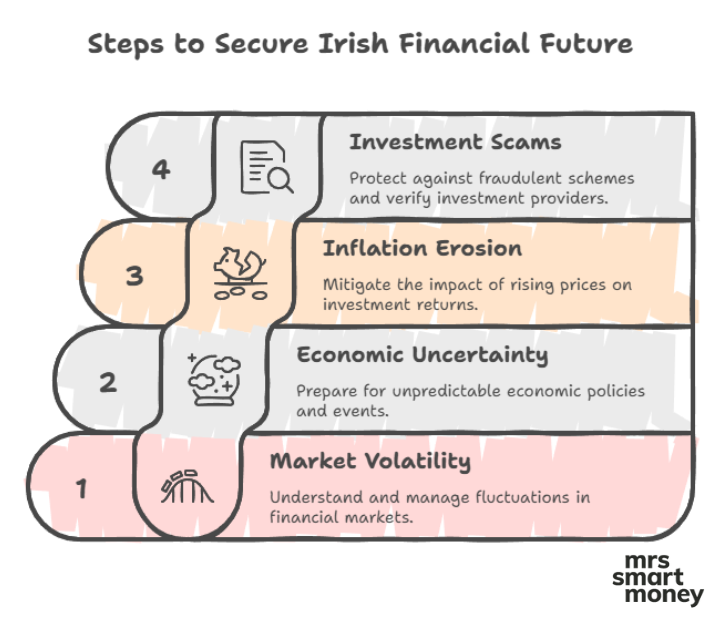

Challenges and Risks to Consider

When pondering why investing is your Irish future, it's wise to acknowledge that it's not always a stroll through a field of shamrocks. Like any good adventure, there are challenges and risks involved. Understanding these factors can help you make informed decisions and develop a resilient investment strategy. Being aware of potential obstacles ensures you're better prepared to navigate market fluctuations and safeguard your financial goals.

Market Volatility (The Bumpy Road!)

Market volatility is a significant hurdle when investing in your Irish future. Fluctuations in the financial markets can impact investment returns and create uncertainty, making it difficult to predict long-term growth. Investors need to be prepared for sudden changes that can affect the value of their portfolios, especially given economic shifts or global events.

What's more, market volatility can lead to emotional decision-making, like panic selling during downturns, which might just undo your clever investment strategies. It's essential to maintain a diversified portfolio and adopt a long-term perspective to navigate these bumps effectively.

Risks also include inflation, interest rate changes, and geopolitical issues that can influence the stability of investments. Understanding these risks allows investors to develop robust strategies that minimise potential losses and secure a prosperous financial future here in Ireland.

Economic Uncertainty (When the Crystal Ball is Foggy)

Economic uncertainty presents another significant challenge when considering investing for your Irish future. Fluctuations in global markets, currency volatility, and unpredictable economic policies can impact the stability of investments and returns. Investors must remain vigilant to these changes, as sudden shifts can affect the value of their assets and long-term financial plans.

Additionally, unforeseen events such as political upheaval or global crises can exacerbate economic instability, making it essential to diversify portfolios and adopt risk management strategies. Understanding and preparing for these uncertainties can help investors navigate turbulent times and safeguard their financial future in Ireland.

Inflation Erosion (The Silent Wealth Shrinker)

Inflation erosion poses a significant challenge when planning for a secure Irish financial future through investments. As inflation increases, the purchasing power of your investment returns diminishes, potentially reducing real gains over time. This can undermine long-term growth strategies if not properly managed.

Investors must carefully consider the risks associated with inflation, such as the need for higher returns to outpace rising prices. Failure to do so may result in the erosion of savings and a diminished ability to meet future financial goals. Diversifying investments and selecting assets that typically outperform during inflationary periods, like equities or certain real assets, can help mitigate this risk.

Additionally, inflation can lead to fluctuating interest rates, which affect bond yields and borrowing costs, further complicating investment planning. Staying informed about economic trends and adjusting your investment strategy accordingly is crucial to protect your Irish future from inflation erosion.

Investment Scams and Fraud (Beware of the Dodgy Dealers!)

When considering why investing is your Irish future, it is important to be aware of the challenges and risks involved, particularly concerning investment scams and fraud. These malicious schemes can target both novice and experienced investors, exploiting trust and a lack of knowledge to deceive individuals into losing their money. Common tactics include fake investment opportunities, Ponzi schemes, and fraudulent online platforms that mimic legitimate financial services.

To protect yourself, always verify the credentials of any investment provider and be cautious of offers that seem too good to be true. Conduct thorough research, seek advice from licensed financial advisors, and be wary of high-pressure tactics that urge immediate decision-making. Recognising common signs of scams and staying informed about evolving fraud methods are crucial steps in safeguarding your financial future as you invest in Ireland's promising opportunities.

Steps to Start Investing in Ireland

Starting your investment journey in Ireland can be an exciting step towards securing your financial future. Whether you're a beginner or looking to expand your portfolio, understanding the key steps to begin investing is essential. By familiarising yourself with local investment options, setting clear goals, and seeking professional advice, you can confidently embark on your path to financial growth in Ireland.

Assessing Your Financial Situation (Know Thyself, Know Thy Wallet!)

Starting your investment journey in Ireland begins with a clear understanding of your current financial situation. Assess your income, expenses, savings, and existing debts to determine how much disposable income you can allocate towards investments. This foundational step helps you set realistic goals and choose suitable investment options.

Next, educate yourself about the different types of investments available in Ireland, such as stocks, bonds, mutual funds, property, and pension schemes. Understanding the risks and potential returns associated with each will guide you in making informed decisions aligned with your financial goals.

After assessing your finances and gaining knowledge, create a comprehensive investment plan. Set specific objectives, a timeline, and risk tolerance to tailor your strategy. Consider consulting with a financial advisor to receive personalised advice and ensure your plan aligns with Irish regulations and tax benefits.

Once you have a solid plan, open accounts with reputable financial institutions or brokers. Ensure you understand their fees, services, and security measures. Start investing gradually, diversifying your portfolio to manage risks effectively while aiming for steady growth over time.

Regularly review and adjust your investment strategy based on changes in your financial situation, market conditions, and personal goals. Staying informed and disciplined will help secure a prosperous Irish future through smart investing.

Researching Investment Options (Time to Put on Your Detective Hat!)

Starting your investment journey in Ireland begins with understanding the importance of informed decision-making. Begin by identifying your financial goals and assessing your risk tolerance to determine the most suitable investment options for you. Conduct thorough research on various asset classes such as stocks, bonds, real estate, and mutual funds, considering their potential returns and associated risks.

Next, educate yourself about the Irish market and regulatory environment to ensure compliance and discover opportunities specific to Ireland’s economy. Consulting reputable financial advisors or investment firms can provide valuable insights tailored to your needs. Additionally, review different investment platforms and accounts available in Ireland, such as ISAs or pension schemes, to find the best fit for your financial plans.

Once you have gathered sufficient information, create a clear investment plan, setting realistic milestones and diversification strategies to manage risk effectively. Regularly monitor your investments' performance and stay updated on economic developments in Ireland to make informed adjustments as needed. Embarking on this structured approach will help you build a resilient and prosperous financial future in Ireland.

Your Financial GPS!

Starting your investment journey in Ireland can open up numerous financial opportunities and help secure your future. Ensure you make informed decisions tailored to your goals. Follow these steps to begin investing confidently in Ireland.

Research Your Investment Goals: Clearly define what you want to achieve, whether it’s saving for retirement, buying property, or building wealth.

Educate Yourself: Learn about different investment options available in Ireland such as stocks, bonds, property, and funds.

Assess Your Financial Situation: Review your income, expenses, debts, and savings to determine how much you can comfortably invest.

Choose the Right Investment Accounts: Open suitable accounts like ISAs, pensions, or investment funds based on your objectives and Irish regulations.

Start Small and Diversify: Begin with manageable investments and spread your assets across different sectors to minimise risk.

Monitor and Review Your Portfolio: Regularly check your investments’ performance and adjust your strategy as needed, in consultation with your advisor.

Opening Investment Accounts (Let the Investing Begin!)

Starting your investment journey in Ireland is a significant step toward securing your financial future. To begin, research the different types of investment options available, such as stocks, bonds, and mutual funds, to determine what aligns with your goals and risk tolerance. Next, choose a reputable financial institution or brokerage firm that offers investment accounts suitable for residents in Ireland.

Opening an investment account typically requires providing identification documents like your passport or driver's licence and proof of address such as a utility bill or bank statement. You may also need to complete a new client application form and agree to the firm's terms and conditions. Once your account is set up, you can fund it through a bank transfer or other accepted methods.

It's essential to educate yourself about the Irish regulatory environment governing investments, including the role of the Central Bank of Ireland and relevant laws. Consider seeking advice from licensed financial advisors to develop a tailored investment plan. Regularly monitor your investments, stay informed about market trends, and review your portfolio periodically to ensure it remains aligned with your long-term financial objectives.

Final thoughts

Starting your investment journey in Ireland requires careful planning and understanding of the local market. Begin by educating yourself about different investment options available, such as stocks, bonds, property, and mutual funds. Next, set clear financial goals to determine your risk tolerance and investment horizon. Creating a long-term investment plan involves diversifying your portfolio to minimise risks and maximise potential returns.

It’s important to research Irish regulations and tax incentives that can benefit investors. Opening a reliable investment account with a reputable financial institution is essential. Regularly reviewing and adjusting your investment strategy ensures it aligns with your evolving financial situation and market changes. Consistency and patience are key to building wealth over time, making investing a crucial part of your Irish future.

Kel Galavan is a leading Irish Money Expert and author of Mindful Money: More Money, More Freedom, More Happiness, with 20 years of investing experience. Having personally navigated her way from 6-figures of debt to a 7-figure net worth, she came to public attention after completing the No Spend Year™. Kel's mission is to instil confidence and control around money. Kel is dedicated to empowering others to take control of their financial futures.

Kel created the first and only in Ireland flagship course, Rise Money™ Become a Confident Investor, specifically designed for Irish people who want to build rock solid personal finances, learn to invest for themselves and navigate the Irish tax system. She demystifies investing, cuts through financial jargon, and provides a practical, step-by-step roadmap to investing success in Ireland.

Disclaimer: The information on this blog is for general knowledge and discussion only, and does not constitute financial advice. You should seek independent professional advice before making any investment decisions. Investing carries risk. Links to third-party sites/products are not endorsements.

Comments