Building Wealth in Ireland: A Step by Step Guide.

- Kel Galavan

- Jun 19, 2025

- 7 min read

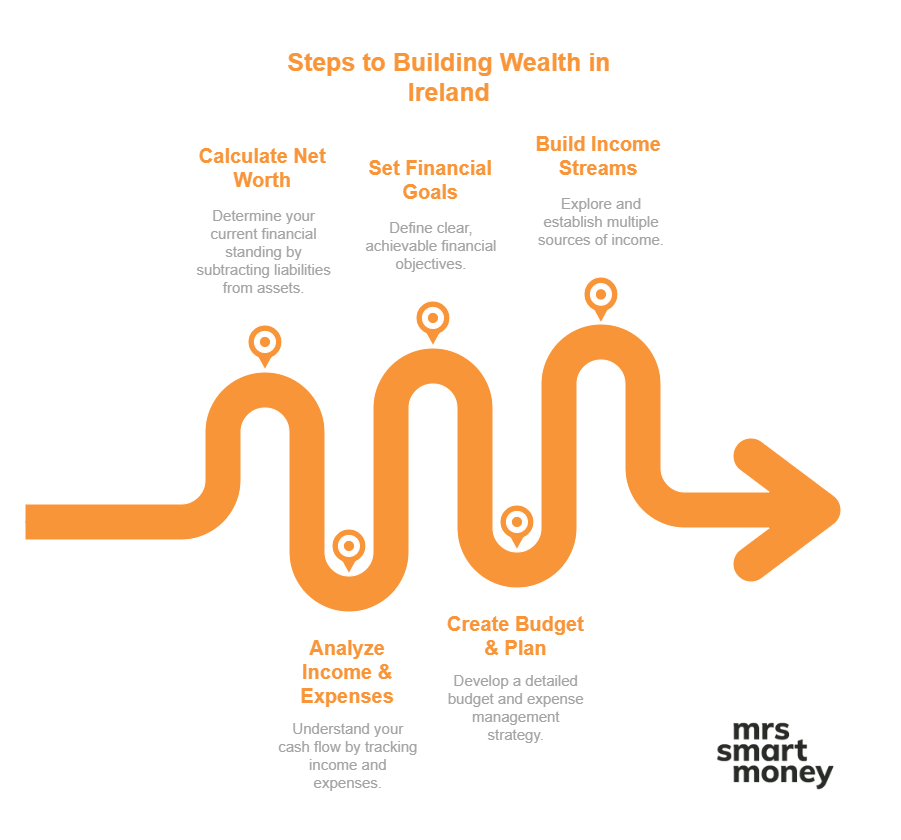

Building wealth in Ireland is not about luck or quick wins - it’s about creating a solid, intentional plan and following it step by step. Whether you're just starting your financial journey or looking to sharpen your strategy, the key is to start where you are, stay consistent, and take control of your money choices. In this guide, I’ll walk through practical steps tailored to the Irish financial landscape - from understanding your current money situation to growing multiple income streams. No matter your income or starting point, building wealth is possible when you combine the right mindset with smart habits. Let’s break it down and set you on the path to long-term financial independence.

Assessing Your Current Financial Situation

Assessing your current financial situation is a crucial first step on the path to achieving financial freedom. By understanding where you stand financially, including your income, expenses, debts, and savings, you can create a clear plan to reach your goals. Taking the time to evaluate your finances helps identify areas for improvement and sets a solid foundation for building wealth and independence.

Calculating Net Worth

Assessing your current financial situation is a crucial step toward achieving financial freedom. By understanding where you stand financially, you can make informed decisions and set realistic goals. One of the first steps in this process is calculating your net worth, a key indicator of your financial health.

Calculating your net worth involves listing all your assets and subtracting your liabilities. Assets include everything you own that has monetary value, such as cash, savings, investments, real estate, vehicles, and valuable possessions. Liabilities are what you owe, including loans, credit card debt, mortgages, and other obligations. Once you have totalled your assets and liabilities, subtract the liabilities from the assets to determine your net worth. This figure provides a clear snapshot of your current financial position and helps identify areas for improvement on your path toward financial freedom.

Analysing Income and Expenses

Assessing your current financial situation is a crucial step toward achieving financial freedom. Begin by gathering all your income sources, including salaries, investments, and any other cash inflows, to get a clear picture of your total monthly or annual earnings. Next, carefully analyse your expenses, such as rent or mortgage payments, utilities, groceries, transportation, and discretionary spending. Tracking these costs over a period helps identify spending patterns and potential areas where you can cut back.

By comparing your total income with your expenses, you can determine your savings rate and establish a realistic plan to reduce debt and build an emergency fund. This comprehensive assessment empowers you to make informed financial decisions, set achievable goals, and develop strategies to improve your financial health - ultimately paving the way toward financial freedom.

Setting Financial Goals

Setting financial goals is a crucial step toward achieving financial freedom. It involves identifying clear, measurable objectives that guide your saving, investing, and spending habits. By establishing these goals, you create a roadmap to build wealth, reduce debt, and secure your future. A strategic approach to goal-setting empowers you to make informed decisions and stay motivated on your journey to financial independence.

Short-term vs Long-term Goals

Setting clear financial goals is essential in achieving financial freedom. It helps organise your efforts and provides motivation to stay on track. When establishing these goals, it's important to distinguish between short-term and long-term objectives. Short-term goals, such as saving for a vacation or paying off small debts, typically span a few months to a year and offer quick wins that boost confidence. Long-term goals, like building a retirement fund or purchasing a home, require disciplined planning and patience over several years or decades. Balancing both types of goals ensures steady progress while maintaining focus on future financial independence.

SMART Goal Framework

Setting clear and achievable financial goals is essential on the path to financial freedom. The SMART goal framework provides a structured approach to goal setting by ensuring objectives are Specific, Measurable, Achievable, Relevant, and Time-bound. This method helps individuals focus their efforts, track progress effectively, and stay motivated as they work toward their financial aspirations. By applying the SMART criteria, you can create actionable plans that lead to successful financial independence.

Creating a Budget and Expense Management Plan

Creating a budget and expense management plan is a vital step toward achieving financial freedom. By understanding your income, tracking expenses, and setting clear financial goals, you can take control of your money and make informed decisions. A well-structured plan helps prevent overspending, save for the future, and build financial stability, paving the way to long-term independence and security.

Tracking Spending Habits

Creating a budget and expense management plan is essential for achieving financial freedom. It helps you understand your income and expenses, allowing you to allocate funds wisely and avoid unnecessary debt. By setting clear financial goals and categorizing your spending, you can identify areas where you can cut costs and save more effectively. Tracking your spending habits consistently provides valuable insights into your financial behaviour, helping you make informed decisions and stay on track.

Regularly reviewing your budget ensures you remain aligned with your goals and adapt to any changes in your financial situation. Ultimately, disciplined budgeting and mindful expense tracking empower you to build wealth, reduce financial stress, and attain lasting financial independence.

Optimising Expenses for Savings

Creating a budget and expense management plan is essential for achieving financial freedom. By carefully tracking your income and expenses, you can identify areas where unnecessary spending occurs and make informed decisions to allocate funds more effectively. Setting clear financial goals helps to prioritise savings and reduce debt, paving the way toward independence.

Regularly reviewing and adjusting your budget ensures you stay on track and respond to changing financial circumstances. Optimising expenses involves negotiating better deals, eliminating non-essential costs, and seeking cost-effective alternatives, all of which contribute to increased savings. Ultimately, disciplined budgeting and expense management empower you to build wealth, establish an emergency fund, and attain long-term financial stability.

Building Income Streams

Building income streams is a vital step towards achieving financial freedom. By diversifying sources of revenue, individuals can create a more stable and sustainable financial future. This approach not only increases earning potential but also provides security against economic fluctuations, paving the way for greater independence and peace of mind.

Employment Income

Building income streams through employment income is a fundamental step toward achieving financial freedom. Relying solely on a single job can limit financial growth, so diversifying income sources is essential. By enhancing skills and seeking higher-paying roles, individuals can increase their earning potential within their employment.

Additionally, negotiating better compensation packages or pursuing promotions can significantly boost income over time. Combining employment income with passive income sources, such as investments or side businesses, creates a more resilient financial foundation. Consistently managing and growing these income streams allows for greater savings, investment opportunities, and ultimately, the freedom to live life on one's own terms.

Side Hustles and Passive Income

Building income streams, side hustles, and passive income are essential strategies on the path to achieving financial freedom. Diversifying your income sources reduces reliance on a single paycheck and opens opportunities for greater financial stability. Starting a side hustle can supplement your primary income, allowing you to save and invest more effectively. Passive income, generated through investments such as rental properties, dividends, or online content, provides ongoing cash flow with minimal active effort. By thoughtfully developing multiple income avenues, you create a resilient financial foundation that accelerates your journey toward independence and long-term wealth.

Investments and Entrepreneurship

Achieving financial freedom often depends on building diverse income streams, making smart investments, and fostering an entrepreneurial mindset. These elements work together to create sustainable wealth and reduce dependence on a single source of income.

Develop multiple streams of income by diversifying your earnings through side businesses, rental properties, or passive income sources.

Invest wisely in stocks, bonds, real estate, or other assets that appreciate over time and generate consistent returns.

Start or grow a business that aligns with your passions and skills, which can provide long-term financial stability and growth opportunities.

Reinvest profits and dividends to compound your wealth and accelerate your path toward financial independence.

Continuously educate yourself about market trends, investment strategies, and entrepreneurial innovations to stay ahead.

Final Thoughts on Building Wealth in Ireland

Wealth-building doesn’t happen overnight, but it does happen with commitment, clarity, consistent action and getting your information from the right sources. By assessing your finances, setting goals, managing expenses, and building diverse income streams, you’re laying the groundwork for lasting financial freedom. Whether you're aiming to retire early, own your dream home, or simply feel more secure with your money, this step-by-step approach can help you get there. Stay focused, stay informed, and remember - the best investment you can make is in your own financial literacy and future. Ireland’s wealth-building opportunities are real - and they’re waiting for you to take the first step.

Kel Galavan is a leading Irish Money Expert and author of Mindful Money: More Money, More Freedom, More Happiness, with 20 years of investing experience. Having personally navigated her way from 6-figures of debt to a 7-figure net worth, she came to public attention after completing the No Spend Year™. Kel's mission is to instil confidence and control around money. Kel is dedicated to empowering others to take control of their financial futures.

Kel created the first and only in Ireland flagship course, Rise Money™ Become a Confident Investor, specifically designed for Irish people who want to build rock solid personal finances, learn to invest for themselves and navigate the Irish tax system. She demystifies investing, cuts through financial jargon, and provides a practical, step-by-step roadmap to investing success in Ireland.

Disclaimer: The information on this blog is for general knowledge and discussion only, and does not constitute financial advice. You should seek independent professional advice before making any investment decisions. Investing carries risk. Links to third-party sites/products are not endorsements.

Comments